After some days of selling pressure, positivity returned to the Pakistan Stock Exchange (PSX) amid developments on the privatisation front as the benchmark KSE-100 Index closed 1.76% higher on Friday.

The KSE-100 started the session with a buying spree that continued till end of the session.

At close, the benchmark index settled at 71,902.09, up by 1,244.45 points or 1.76%.

On Thursday, bearish sentiment had prevailed at the PSX as the benchmark KSE-100 Index lost nearly 450 points to settle at 70,657.64.

Across-the-board buying was witnessed on Friday, however, in key sectors including automobile assemblers, cement, chemical, commercial banks, oil and gas exploration companies, OMCs and refinery, with index-heavy stocks including OGDC, PPL, DGKC, PSO and SHEL trading in the green.

Interest was also witnessed in Pakistan International Airlines (PIA) stocks after it was reported that 10 bidders, including Pakistani tycoon Arif Habib and aviation-based company Gerry’s Group, were looking to buy a majority stake in PIA.

Pakistan’s government has previously said it was putting on the block a stake of between 51% and 100% in the loss-making airline as part of reforms urged by the International Monetary Fund (IMF).

The disposal of the flag carrier is a step that past elected governments have steered away from as it is likely to be highly unpopular, but progress on the privatisation will help cash-strapped Pakistan pursue further funding talks with the IMF.

In a key development, the United States said that technical engagements through trade and investment ties are priorities of Pak-US bilateral relations.

During a press briefing, US Spokesperson Matthew Miller was asked about economic reforms in Pakistan.

“When it comes to efforts to stabilise its economy, including through reaching an agreement with the International Monetary Fund, we support those efforts,” the spokesperson said.

Globally, Asian stocks rallied on Friday after Apple record $110 billion share buyback plan lifted the tech sector, while the yen put more distance from recent 34-year lows to cap a tumultuous week that saw suspected interventions from Tokyo.

With markets in Japan and mainland China closed on Friday, regional trading activity is likely to be subdued as traders look ahead to the U.S. nonfarm payrolls data later in the day.

MSCI’s broadest index of Asia-Pacific shares outside Japan, opens new tab rose 1.5% and was set for a second straight week of gains.

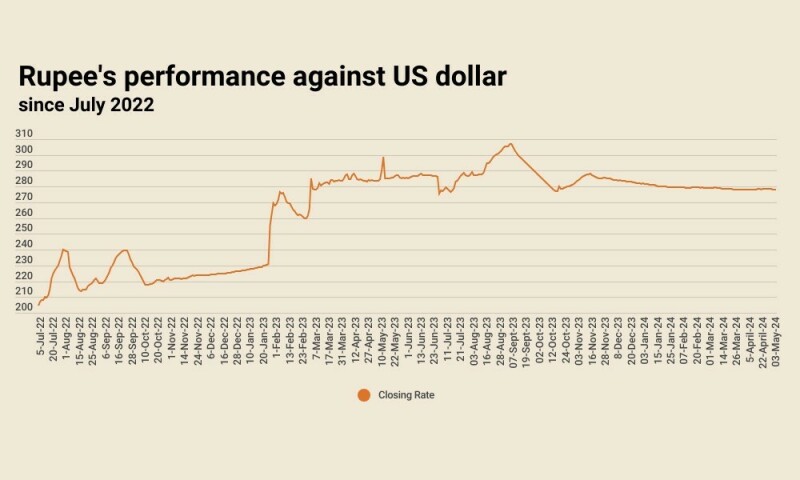

Meanwhile, the Pakistani rupee registered marginal improvement, appreciating 0.03% against the US dollar in the inter-bank market on Friday. At close, the local unit settled at 278.21, a gain of Re0.09 against the greenback, as per the State Bank of Pakistan.

Volume on the all-share index increased to 452 million from 437 million a session ago.

The value of shares also rose to Rs24.54 billion from Rs19.02 billion in the previous session.

Pak Petroleum was the volume leader with 26.66 million shares, followed by Hascol Petrol with 26.57 million shares, and Fauji Cement with 19.31 million shares.

Shares of 378 companies were traded on Friday, of which 248 registered an increase, 104 recorded a fall, while 26 remained unchanged.